2025 Global PC Scale and Distribution Worldwide

Written with the help of AI Research Assistants: Claude.ai, Perplexity.ai and Google Gemini

The Global PC Market

In today’s digital age, personal computers have become the backbone of modern productivity, creativity, and connectivity. But just how many PCs are there in the world, and who’s making them? Let’s dive into the fascinating numbers that define the global computing landscape.

We are we’re living in an era of platform specialization:

- Traditional productivity computing used mostly by knowledge workers, remains Windows-dominated.

- Creative professional work sees strong macOS representation

- Mobile tablet computing is an iPadOS vs Android battle

- Gaming consoles represent yet another specialized platform ecosystem

- Professional Developer, a trained individual who builds complex, secure, and scalable applications as their full-time career. This includes roles like backend, front-end, and mobile developers who are proficient in traditional programming languages, and use Linux, Windows Subsystem for Linux (WSL) and macOS

- Citizen Developer, a non-technical employee who leverages intuitive low-code and no-code platforms to quickly build applications that solve specific problems for their team or department. The rise of the citizen developer empowers non-technical staff to innovate and automate tasks, complementing the work of professional IT teams. typically knowledge workers

Understanding these distinct markets is crucial for anyone analyzing the true state of personal computing platforms and predicting future trends.

Quick note about on-device AI Use: While the “AI-PC” is gaining traction, much of the foundational AI work remains OS platform-agnostic, relying on local containers, universal apps, local servers and cloud-based compute power. However, for local inference and development, platforms are differentiating themselves. As native OS applications begin to utilize local AI, any of the above mentioned use cases will benefit, further differentiating the user choice of a platform.

Over 2 Billion PCs Worldwide

When we talk about the total number of PCs currently in use around the globe, we’re looking at a truly impressive figure: over 2 billion computers worldwide. This installed base represents desktops, laptops, and workstations actively being used by individuals, businesses, and organizations across every continent.

To put this in perspective, that’s roughly one computer for every four people on Earth. The number has grown exponentially from just a few million in the 1980s to this massive installed base today, representing one of the most successful technology adoptions in human history.

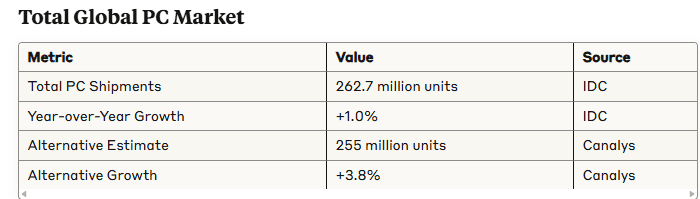

The Annual Market: 262.7 Million New PCs in 2024

While the installed base tells us about the total computing power available globally, the annual shipment numbers reveal the market’s current health and trajectory. In 2024, the global PC market shipped approximately 262.7 million units, representing a modest 1% growth compared to the previous year.

This growth, while small, signals a recovery after several challenging years marked by economic uncertainty, supply chain disruptions, and market saturation in developed countries. The industry is cautiously optimistic about future growth, driven by several key factors:

- Windows 10 End-of-Support: With Microsoft ending support for Windows 10 in October 2025, enterprises are upgrading their hardware

( See Staggering Number of Windows 10 PCs Still Out There! ) - Enterprise Refresh Cycle: Many businesses purchased PCs during the pandemic but are now facing the need to upgrade aging hardware, particularly with Windows 10’s impending end-of-support creating urgency.

- AI PC Adoption: New AI-enabled computers are creating fresh demand, though at higher price points. AI-capable PCs as the next growth driver, though adoption has been slower than initially expected due to higher costs and still-developing use cases.

- Emerging Markets: Continued growth in developing countries where PC penetration is low.

Want More Updates? =>Subscribe to my JorgeTechBits newsletter

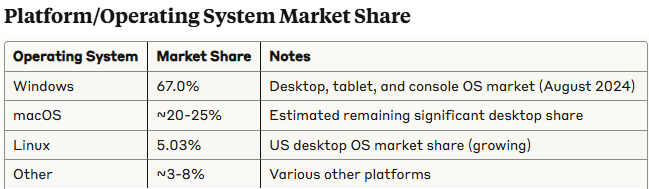

PC Platform Wars: Windows Still Dominates

When it comes to operating system market share, the landscape remains remarkably stable where Windows continues its dominance while macOS maintains a strong presence of the desktop market, particularly strong in creative industries and among consumers willing to pay premium prices for Apple’s ecosystem integration. Linux has been gaining ground particularly notable in developer communities, servers, and among privacy-conscious users seeking alternatives to proprietary systems.

Chrome OS Strong in Education

ChromeOS typically holds a market share of approximately 1% to 2% globally. ChromeOS is a dominant force in the education market, especially in the United States. It holds a significant share of the K-12 education device market, with some reports showing its share at over 50%. Its affordability, ease of management, and simple user interface make it a top choice for schools

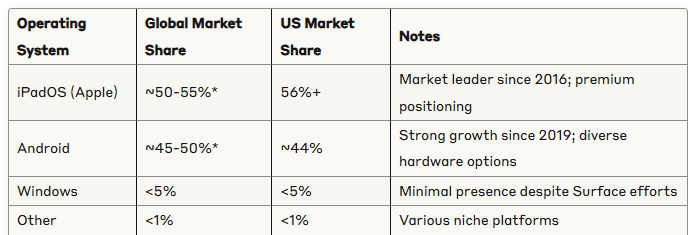

The Tablet Revolution: A Different Story Entirely

The tablet market tells a completely different story, representing one of the most significant shifts in personal computing over the past decade.

Windows tablets use the full Windows (the same desktop OS with touch optimizations), occupy a tiny niche in the tablet market, despite Microsoft’s efforts with Surface devices and other Windows-based tablets. This represents a stark contrast to Windows’ desktop dominance and highlights how different form factors can completely reshape platform competition. iPadOS (Apple) leads the global tablet market and dominates in key regions like the United States, while Android, who is available in more affordable alternatives and greater hardware variety from multiple manufacturers is popular globally.

*Global percentages estimated based on regional data and market trends

iPadOS (Apple) leads the global tablet market and dominates in key regions like the United States, where it holds over 56% market share as of 2024. Apple’s iPad has maintained its position as the premium tablet choice since its introduction in 2010, revolutionizing not just tablet technology but consumer expectations for mobile computing.

Android represents the primary competition to iPadOS in the tablet space, with the two platforms essentially controlling the entire market between them. Android tablets have gained significant traction since 2019, offering more affordable alternatives and greater hardware variety from multiple manufacturers.

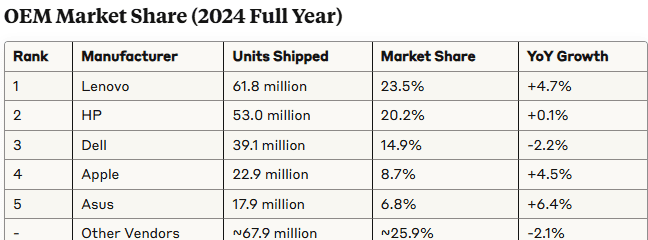

The Manufacturers: Who’s Building Our Computers?

The PC manufacturing landscape is dominated by a handful of major players, with clear market leaders emerging from the intense competition.

- Economic Headwinds: Global economic uncertainty, potential tariff impacts, and tight budgets continue to challenge market growth, particularly in price-sensitive segments.

- Consolidation: The market share gains by major manufacturers come largely at the expense of smaller players, indicating ongoing industry consolidation.

Lenovo, a Chinese company has maintained its leadership position through aggressive pricing, strong enterprise relationships, and a diverse product portfolio spanning budget laptops to high-end workstations. HP’s stability in a volatile market speaks to their strong brand recognition and established distribution channels. They’ve maintained their position particularly well in the printer-integrated business market. Dell’s strength lies in their direct-to-business sales model and strong enterprise relationships, though they’ve faced challenges in the consumer market where competition has intensified. Apple success and growth comes from their premium positioning, ecosystem integration, and strong brand loyalty, allowing them to maintain higher margins while growing market share. ASUS has carved out a strong niche in gaming laptops and high-performance systems, benefiting from the growing PC gaming market and content creation trends.

Looking Ahead

The global PC market’s scale—with over 2 billion computers in active use and hundreds of millions more shipped annually—represents more than just impressive numbers. It reflects the democratization of computing power, enabling everything from small business operations to scientific research, creative expression, and global communication.

The global PC market isn’t uniform across regions. Developed markets like North America and Europe show signs of saturation, with replacement cycles driving most sales. Meanwhile, emerging markets in Asia, Africa, and Latin America present growth opportunities as internet infrastructure improves and digital literacy increases. Government initiatives also play a crucial role. For instance, government subsidies in China helped drive better-than-expected Q4 2024 performance, demonstrating how policy decisions can significantly impact regional demand.

As we look to the future, the PC market may be mature, but it’s far from stagnant. The industry continues to innovate, adapt, and find new ways to serve the computing needs of an increasingly digital world. Whether it’s through AI integration, improved sustainability, or new form factors, the next chapter of the PC story promises to be as compelling as its remarkable past.

As we move forward, several trends are looking to shape the PC market’s future:

- Sustainability Focus: Manufacturers are increasingly emphasizing energy efficiency, recyclable materials, and longer product lifecycles in response to environmental concerns and regulations.

- Hybrid Work Continuation: The permanent shift to hybrid work models sustains demand for portable, powerful laptops that can serve as primary computing devices.

- Gaming Growth: PC gaming continues to grow globally, driving demand for high-performance systems and creating opportunities for specialized manufacturers.

- Edge Computing: As more processing moves to the edge, we may see new categories of compact, powerful PCs designed for specific industrial and IoT applications.

Resources

- Image Credit: by Viggo from Pixabay

- Canalys Newsroom – Global PC shipments grew 3.8% to 255 million in 2024

- Canalys Newsroom – Worldwide PC shipments up 9% in Q1 2025 but tariffs threaten future market performance

- The PC Market Closed out 2024 with Slight Growth and Mixed Views on What 2025 Will Bring, according to IDC

- IDC – Personal Computing Devices Market Insights

- IDC says PC shipments will increase because of tariffs, now expects 274 million PCs to ship in 2025 | Tom’s Hardware

Want More Updates? =>Subscribe to my JorgeTechBits newsletter